We have been repeating in previous articles the importance of saving, but even more important is the fact of investing this money. It is useless to have your savings under the mattress. The best thing you can do is create more money through the investment of it and not your work. And here comes the importance of compound interest.

“The worst transaction you can make is to exchange your time for money. You can always get more money, but you can never buy more time.”

But how to invest? What do I need to do to earn a profit on my savings? There is a concept, which even Albert Einstein himself considered the greatest mathematical discovery and the most important invention in the history of humanity: compound interest.

What is the composed interest.

According to the Investopedia portal, compound interest or capitalization is the process by which profits are generated thanks to the reinvestment of the profits generated by an asset.

It depends on two variables: reinvestment of profits and time. A bit confusing? To make this concept clearer, read the example below.

Example #1 of compound interest.

If you invest $4,000 today at an interest rate of 5%, you will have $4,200 ($4,000 x 1.05) next year.

Everything is that you do not withdraw these $200 in profits but reinvest them. This way you will have $4,410 the following year. They may not seem like incredible gains, however, did you make any effort to get them? The answer is no.

Example #2 of compound interest.

Now imagine the following scenario. Instead of investing only $4,000 the first year, what would happen if you saved and invested the same amount each year? At the end of the third year you would not have $4,410, you would have obtained $17,871, that is, $13,461 more and $5,871 in profit.

Again keep in mind that you didn’t have to lift a finger to get those profits.

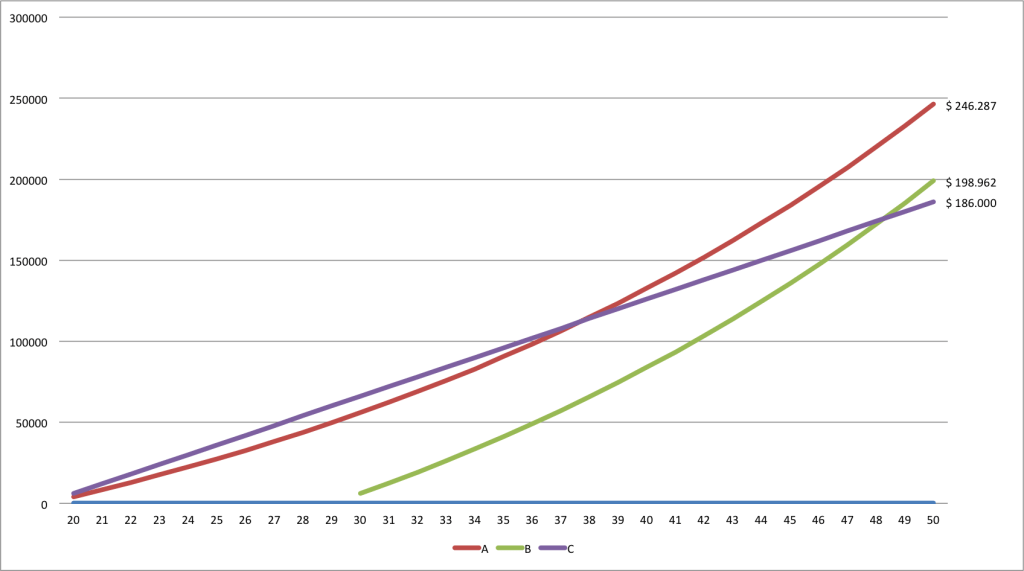

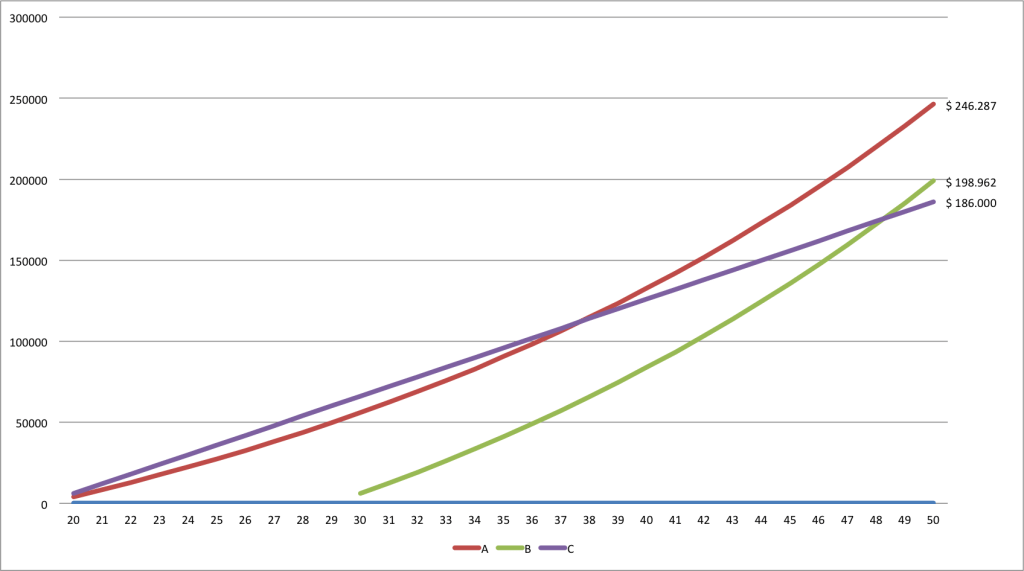

A person who starts his investment plan (using the benefits of compound interest) at 20 and ends at 40, will have more money than someone who starts saving a certain amount annually without touching it from age 30 until he turns 70. Observe the following Examples so you can compare.

Example #3 of compound interest.

We will take the case of 3 people that we will call A, B and C. Individual A has made the wise decision to start saving and invest his savings at age 20. He will make some sacrifices to hold his ground, but he knows it will be worth it in the long run. His initial investment amount will be $4,000 at a rate of 4%, making annual contributions of $4,000.

For his part, individual B has made the decision to invest 10 years later and start at age 30. For this reason, your initial amount will be $6,000 ($2,000 more than A). He will have exactly the same rate of 4% and will additionally make annual contributions of $6,000.

Finally, individual C does not want to take risks and only trusts in having his money saved at home. His money does not earn interest, sits still, and will only be used in emergencies. Like individual A, he decides to be cautious and start saving all 20 years. Each year he will save $6,000.

Let’s see what will be the fate of each of these examples when they are 50 years old.

Taking into account the previous results we can draw the following conclusions:

conclusions.

- Start saving and investing as soon as possible. It will give you the possibility of making smaller contributions and getting better results. Individual A started saving at an early age and despite the fact that she was making smaller monthly contributions than B, she ended up having $47,000 more.

- Just saving is not enough. The idea of saving is that you put money to work for you, so that you can stop working for money. Even when C started saving at age 20, at age 50 she had less money than B, who started 10 years later.

- With enough consistency and planning, you could even stop making annual contributions and start living off the interest your money earns. You would have your own ATM.

The values used in these examples were taken in order to make the examples as clear as possible.

And remember that if you are really interested in creating your own business, you can purchase our book “How to create a company while working: Discover how to manage your time, manage your money and motivate yourself while creating a company and working for another” , where you will find all the information you need to found your own company, without having to leave your job.