In the following article you will know exactly what the breakevenwhy it is useful and how you can calculate it.

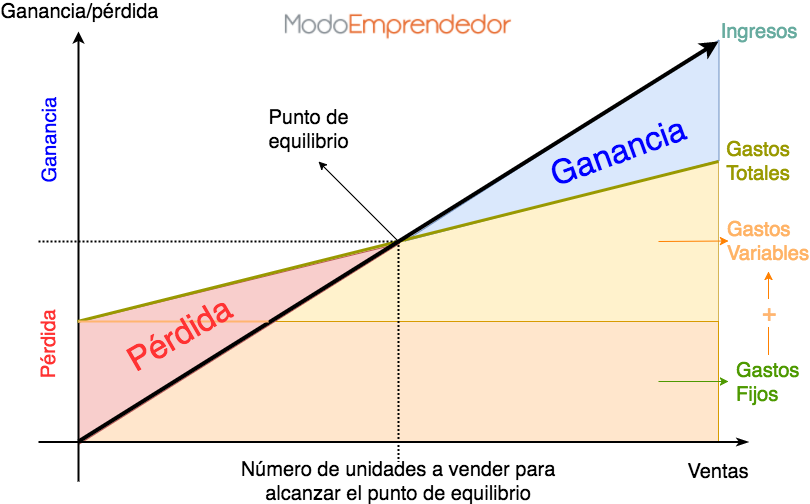

The break even point, or the Break Even Point (BEP) in English, is in accounting terms a point at which the total costs of a company is equal to the total profits. There are no net gains or losses.

In other words, the break-even point is a financial result that reflects that a business has no profit or loss. Or in another way, it is when the total income received is equal to the initial investment made.

Break-even point graph.

The calculation of the break-even point is essential in the field of financial analysis. In addition, it is a tool widely used by business owners.

Once you know the costs of the product that your company sells, both fixed and variable; You can use this information to calculate the breakeven and know how long the income will cover the expenses.

Also read: Compound interest. The concept that few know and the rich take advantage of every day.

On the other hand, you can also use this information to find out how many product units you need to sell to break even.

Finally, the calculation of the break-even point will allow us to know from what amount of sales we are going to start generating profits.

All this information is key to decision making.

What variables do I need to know to calculate the break-even point.

To know the break-even point in terms of sales volume; You will need to know three variables:

1. Fixed costs: They are those costs independent of sales volume, such as rent. As its name says, they are costs that do not change; they are always the same.

2. Variable costs: They are those costs that depend on the volume of sales. For example, the production costs of the product. The larger the output, the higher the costs.

3. Sale price: The sales value you assigned to the product.

How to Calculate Break-Even Point

The break-even point is equal to the total fixed costs divided by the difference between the unit price minus the variable costs.

Break-Even = Fixed Costs / (Unit Price – Variable Costs)

It should be noted that in this formula, fixed costs are expressed as a total of all fixed costs of the company. On the other hand, both the price and the variable costs are expressed in units. The final price of a single product minus the variable costs of a single product.

Example to calculate the break-even point.

The Ceucase company sells a protector for mobile phones that fits any phone regardless of its size or model. You sell your product for $15 and the costs of producing a unit of product, that is, your variable costs are $5. All your fixed expenses (salaries, utilities, materials, rent) are $4,500.

Fixed costs: $4500

Variable costs: $5

Price: $15

With this information, we already have all the necessary data. Let’s see.

Breakeven:

= $4500 / ($15 – $5)

= $4500 / $10

= 450

Also read: How to make a quick and easy budget for your personal life.

After the calculation, this result shows us that Celucase needs to produce and sell 450 units to cover its costs. Selling this amount Celucase will break even, covering its costs but making no profit.

Depending on the situation of the company, you may find it difficult to sell this number of units, so you will have to make decisions.

In this case you only have two possible paths. On the one hand you can increase the price of your product and on the other you should look for ways to reduce costs.

As a business owner, you will know that these three variables are directly related. The break-even point is one of many financial analysis tools, however it is an excellent starting point and a good method for setting a price that fits your projections.

And remember, if you are really interested in creating your own business, you can read our book “How to create a company while working: Discover how to manage your time, manage your money and motivate yourself while creating a company and working for another” , where you will find all the information you need to found your own company, without having to leave your job.